Inflation will sail around the Cape of Good Hope

Get ready for the storm: five centuries after Vasco da Gama filled Portugal with spices and riches via the Cape of Good Hope, the navigator's route becomes once again the main maritime trading route between the Orient and Europe, bringing us a little bit of everything.... at higher prices

In mid-October last year, following an already complex period of pandemic and war in Ukraine, another war broke out, this time between Israel and Hamas in the Palestinian enclave of the Gaza Strip. Shortly thereafter, because of this conflict, Yemen’s Houthi militias began attacking Western and Israeli merchant ships in the Red Sea. To a more distracted observer, this event may appear to be yet another metastasis of a historical dispute that generates strong cross-border sympathies in the Middle East region, but the reality is that it is of the utmost international relevance, as we shall see.

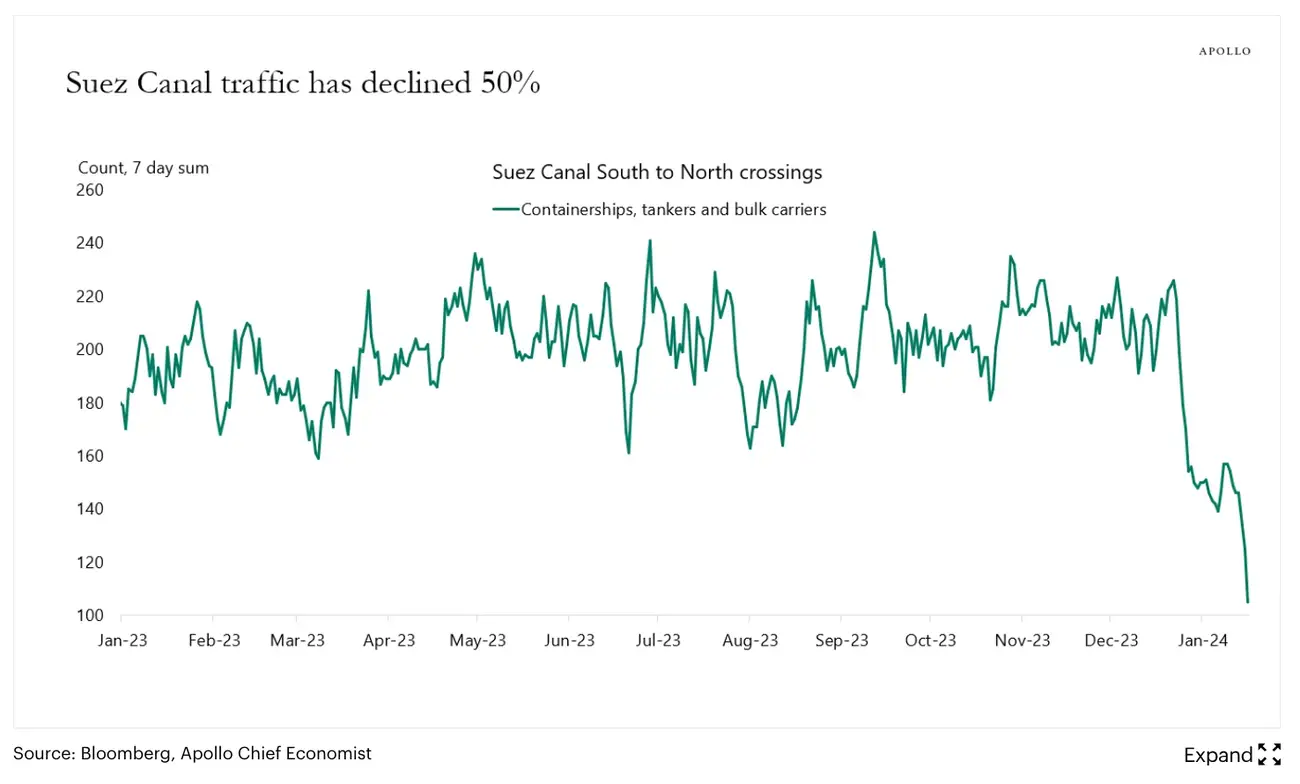

Since China and its neighboring countries are now the world’s largest factories, most finished products, intermediate parts and even raw materials come from this part of the world by sea. In the case of Europe, the route used is the Suez Canal, through which an average of 56 ships transit every day.

Targeted against these ships, the attacks in the Red Sea created chaos on the main East-Europe Sea route, reducing cross-channel traffic by 50%, as many shipping companies opted to suspend transport along this route and to seek necessarily longer, slower and, inevitably, more expensive alternatives. It is therefore not surprising that several countries have rushed to deploy military means in the region and to attack Houthi positions, as well as China’s warning to Iran.

Cascade Effect

The impact on the world economy and trade of the suspension of maritime trade from the East through the Suez Canal will be greater the greater the insecurity and the longer it persists. But what can be expected is shortages and higher commodity prices, which will cause a “cascade” effect that will tend to spread to all products transported by sea.

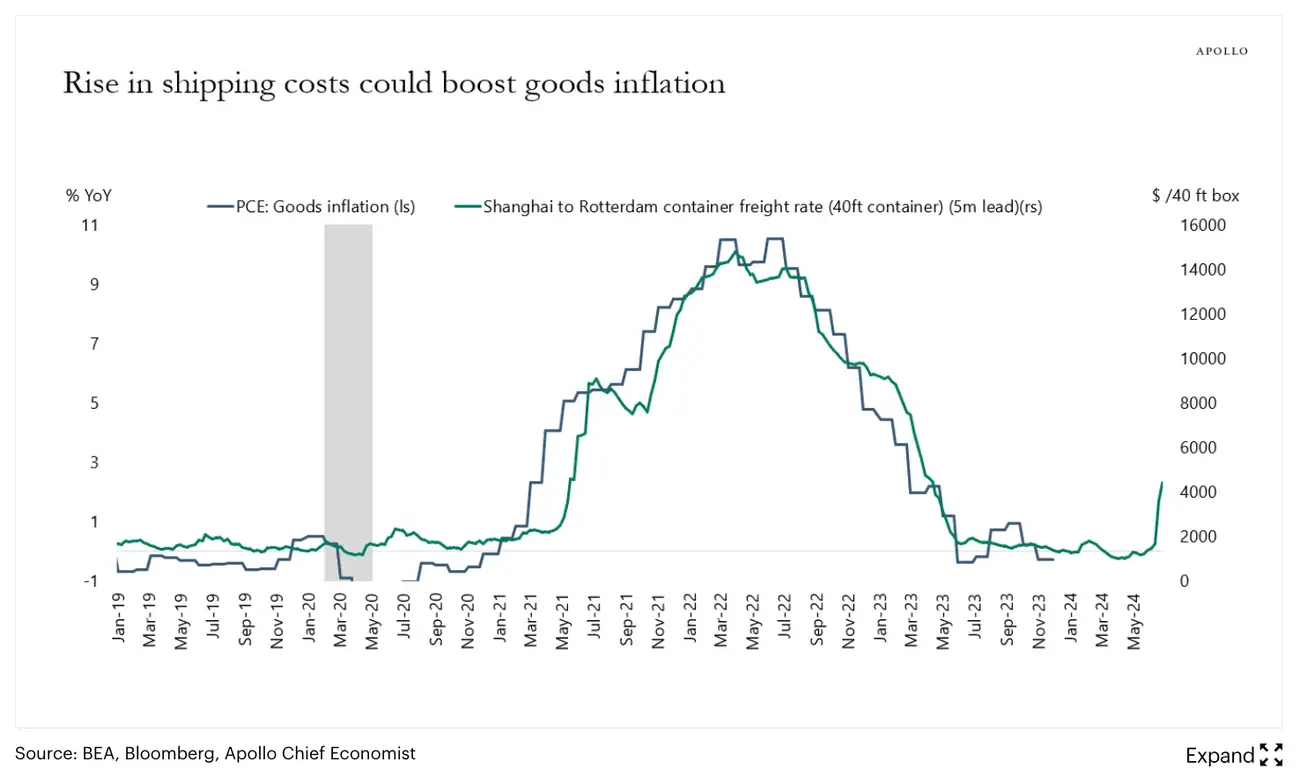

During the pandemic years, shipping also suffered major disruptions. Unable to dock, ships remained anchored offshore, freezing the entire global logistics chain. The price of ocean freight skyrocketed by more than 700%[1]. This was followed, as expected, by a rapid rise in inflation.

In the current situation, ships are forced to sail along the route discovered by Vasco da Gama, rounding the Cape of Good Hope. Five hundred years later, this is once again the main trade route between the East and Europe. The problem is that, romanticism aside, the route is 40% longer, which increases freight time and fuel costs, while reducing the availability of ships.

This time transportation costs have “only” soared by 300%. But there is little cause for optimism.

When we look at the EU and Shanghai-Rotterdam container cost inflation curves, we see that the two are reasonably correlated, with a six-month lag. Let’s see – container costs start to rise in July 2020 and inflation spikes in the EU six months later. Container costs peak in January 2022 and inflation in July 2022. And so on.

It is easy to understand the phenomenon with a practical example. In October 2023, a container with 5,000 units of a product with a unit cost of 10USD would have a freight cost of 2,000USD[1] and the final cost of the product would be 10.4USD. In January of this year, transporting the same container at 6,000 USD, the same product would arrive in Europe costing 11.2 USD, i.e. 8% more.

So, get ready: inflation is on the rise again. Just round the Cape of Good Hope to start landing in Europe. Or is it the Cape of Storms?

Miguel Allen Lima

ARQUILED CEO

[1] Trading Economics e Eurostat:

https://tradingeconomics.com/european-union/inflation-rate#:~:text=Inflation%20Rate%20in%20European%20Union,source%3A%20EUROSTAT